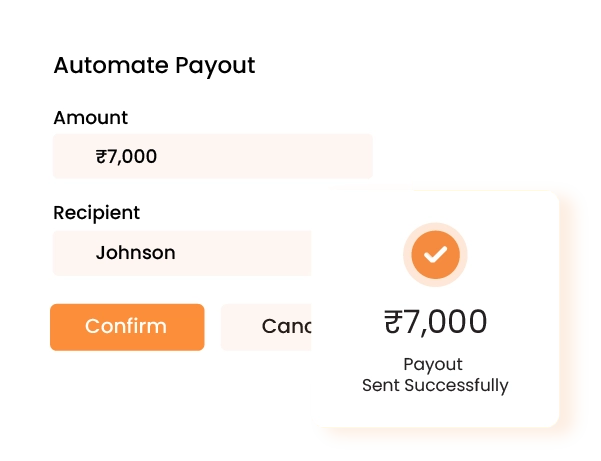

Create payout triggers based on custom rules or milestones. From invoice approvals to performance metrics, automate every step intelligently, ensuring financial operations remain consistent, efficient, and fully aligned with workflow logic.

Schedule payouts precisely when needed, minimizing delays and human intervention. Enhance cash flow predictability while ensuring your vendors and partners receive funds right on time without operational bottlenecks or confusion.

Automatically disburse payments to vendors according to predefined schedules. Reduce manual effort, ensure timely settlements, and maintain consistent cash flow management without delays or errors across all vendor accounts.

Validate vendor details, payment amounts, and transaction accuracy before execution. Minimize errors, prevent disputes, and ensure every settlement is precise, compliant, as well as dependable for smooth financial operations.

Track every vendor payout in real time from initiation to completion. Identify delays, monitor progress, and provide instant updates for full transparency as well as operational confidence across all payment cycles.

efficiently.webp)

Validating user KYC and profile data.

Cross-checking account ownership details.

Reviewing uploaded documents, mobile & email verification.

Securely validating identity proofs and uploaded records. Ensuring accuracy across mobile and email data.

Cross-verifying PAN, Aadhaar, and business documents. Instant OTP checks confirm contact authenticity.

AI-driven scan of KYC and business certificates. Verifies linked phone numbers and email IDs in real time.

System confirms all checks before marking user as verified.

Ensure only approved payouts are executed through role-based controls and validations. Maintain transparency, reduce risks, and keep every disbursement fully accountable.

Auto-refreshing data provides continuous system performance insights