Submit required KYC documents online or in-branch. Approval is quick, ensuring you start managing business finances immediately and hassle-free.

Maintain your current account without worrying about minimum balance requirements. Focus on growing your business, managing transactions freely, and enjoying complete flexibility in day-to-day financial operations.

Automatically assign payments to virtual accounts for precise tracking. Enhance visibility as well as manage collections efficiently with intelligent mapping tools.

Payments are routed automatically to the correct accounts based on predefined rules.

Incoming payments are identified instantly as they are received.

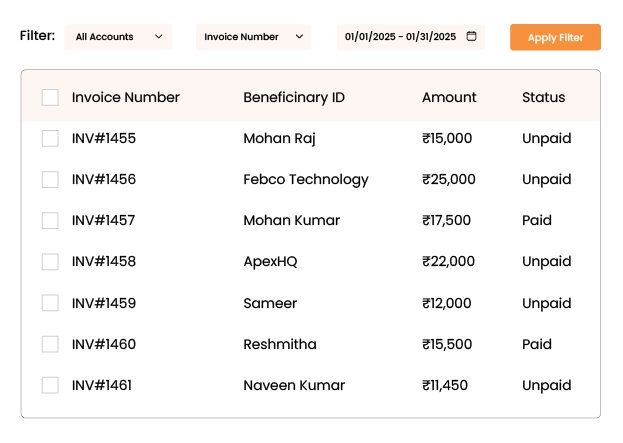

Multiple payments are reconciled instantly against invoices or accounts.

Assign payments to multiple beneficiaries simultaneously according to your mapping logic.

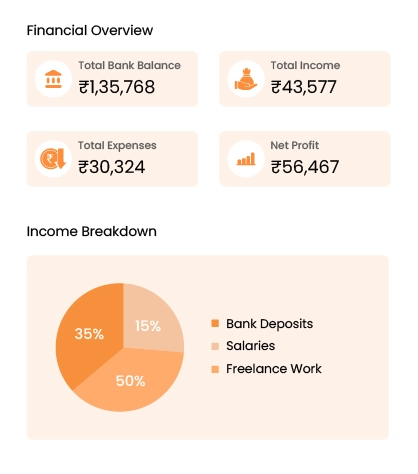

Generate detailed reports to track expenses, revenue, and trends. Insights help you plan strategically and make smarter financial decisions.

Allocate resources efficiently with clear visibility into cash flows. Better budgeting supports growth without unnecessary financial stress or surprises.

Receive guidance from experts when needed. Assistance ensures smooth operations and helps resolve issues promptly without affecting business continuity.

Simplify transactions with UPI and API connectivity

Easily link and configure UPI accounts within minutes. Set up payment preferences, manage multiple accounts, and streamline transaction acceptance to ensure a smooth, fast, and reliable digital payment experience for your operations.

Protect every transaction with robust API authentication and tokenization. Sensitive data is encrypted and securely transmitted, ensuring safe payment processing, preventing unauthorized access, and maintaining integrity.

Track and synchronize all payments in real time. Gain instant visibility into transactions, monitor status updates continuously, and ensure accurate reconciliation, giving you complete control over cash flow and operational efficiency.

Explore our detailed FAQs to understand the process, benefits, and smooth management of your current account efficiently.

Submit required KYC documents online or in-branch. Approval is quick, ensuring you start managing business finances immediately and hassle-free.

Provide business registration, PAN card, address proof, and identity verification. All documents are verified swiftly for smooth account setup.

Yes, multiple accounts can be linked and managed efficiently. Consolidated tracking ensures smooth operations without confusion or delay in transactions.

Typically, account approval is completed within a few business days. Rapid verification ensures minimal waiting time for your operations.