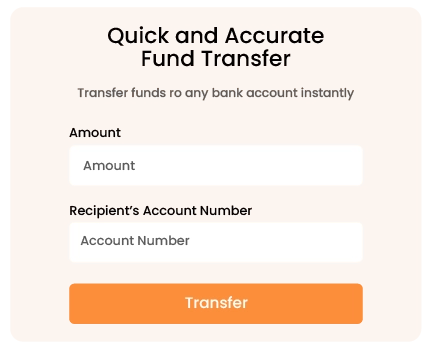

Transfer money instantly while maintaining security, speed, and operational efficiency across all transactions.

Payments are completed without delays, ensuring faster availability of funds for business operations.

Stay informed with instant notifications for every transaction processed successfully.

Automatic updates make tracking and reconciling accounts easier and more accurate.

Monitor payments effortlessly to maintain financial oversight and accountability efficiently.

Instant payment solutions simplify transactions, offering customers and businesses a fast, hassle-free method to send and receive money with complete confidence.

Automated reconciliation and tracking tools ensure transparency, giving businesses full control over cash flow and enabling smarter, faster financial decision-making.

Monitor every transaction with intelligent fraud detection algorithms. Identify suspicious patterns instantly, prevent unauthorized activities, and safeguard payments.

Authenticate users with two independent verification layers. Reduce unauthorized access, strengthen security, and ensure only legitimate users complete transactions across platforms.

Generate unique, time-bound tokens for each transaction securely. Protect sensitive information, prevent replay attacks, and maintain safe, reliable payment processing.

Confirm user credentials thoroughly before payment authorization. Ensure legitimacy, minimize fraud risks, and protect every transaction while maintaining operational flow.

Monitor active sessions continuously for unusual anomalies. Prevent hijacking, enforce timeout policies, and protect user accounts across all payment channels effectively and reliably.

Automatically validate all user-entered payment details for accuracy and completeness. Eliminate invalid submissions, minimize delays, and ensure every transaction request is correctly captured before execution, maintaining smooth and reliable payment flows across integrated systems.

Authenticate transaction information instantly using secure verification mechanisms. Prevent fraudulent activity, preserve data integrity, and ensure only legitimate payments proceed consistently and efficiently across every channel without impacting speed or user experience.

Deliver immediate confirmation of payment outcomes to users and internal systems. Remove uncertainty, improve transparency, and maintain accurate, traceable records for each completed transaction consistently, efficiently, and reliably across all platforms and reporting tools.